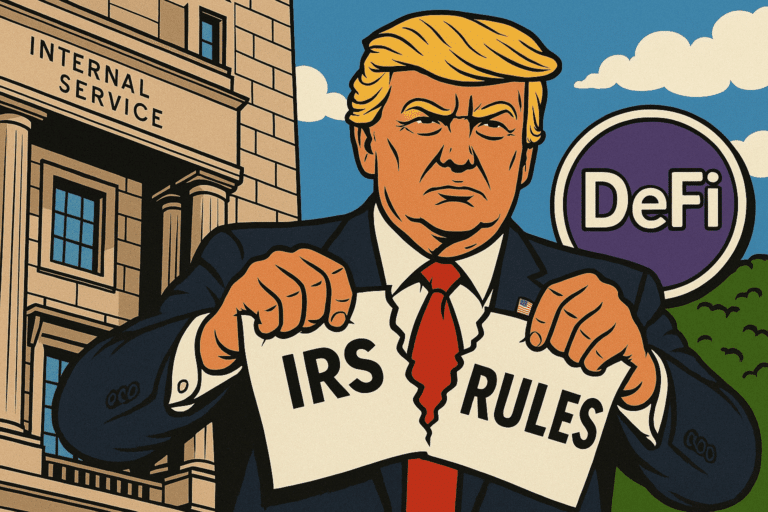

What Was the IRS DeFi Broker Rule?

This rule required decentralized finance (DeFi) platforms to report their users’ transactions to the IRS. It also attempted to redefine who constitutes a “broker” in DeFi, which included a number of software developers and participants in protocols. The rule caused concern regarding privacy, innovation, and regulatory burden.

Many in the crypto space believed it would:

- Infringe on user privacy

- Overwhelm the IRS during tax season

- Discourage blockchain innovation

- Treat non-custodial players unfairly

How the Bill Was Passed

This bill, formally called H.J. Res. 25, was introduced by Senator Ted Cruz and Representative Mike Carey under the Congressional Review Act (CRA). The CRA allows Congress to repeal recent federal regulations.

The resolution passed both chambers with strong bipartisan support:

|

Chamber |

Vote Count |

|

Senate |

70–28 |

|

House |

292–132 |

Representative Carey emphasized that this is the first crypto-related law ever signed and also the first CRA measure on a tax issue to become law.

“This bill frees the crypto space from unnecessary burdens,” Carey said. “It puts focus back on real taxpayer needs.”

Industry Reaction: A Win for Crypto Innovation

Industry leaders welcomed the decision. Bo Hines, Executive Director of the President’s Council of Advisers on Digital Assets, expressed strong support on X (formerly Twitter):

“Huge moment! First crypto legislation ever. Repealing the IRS rule protects innovation and privacy. A big step forward.”

Many in the crypto community saw this as a positive signal. The move is expected to attract more innovation, protect privacy rights, and reduce red tape for builders and users in the DeFi ecosystem.

SEC’s New Guidance Brings Clarity

The same day this bill was signed, the SEC released fresh guidance through its Division of Corporation Finance. The goal? Clearer rules around how securities laws apply to crypto asset offerings.

Key points of the SEC guidance:

- Offerings must disclose risks like price swings and tech challenges

- Transparency is critical to protect investors

- Rules apply to all crypto-related securities offerings

This guidance is seen as a step toward a more balanced and informed regulatory system for crypto markets.

Helium Network Gets Regulatory Relief

In another major move, the SEC dismissed securities charges against Nova Labs, the team behind Helium Network. This meant Helium’s tokens – HNT, MOBILE, and IOT – are no longer considered unregistered securities.

Helium responded with optimism:

“Now, Helium and DePIN projects can grow freely. We’re ready to help connect the world without barriers.”

This decision reflects a change in how the SEC is approaching crypto enforcement. Since Gary Gensler’s exit in January 2025, the agency has dropped several lawsuits and softened its stance on crypto.

Ripple Lawsuit Also Settled

Just weeks before, the SEC also dropped its long-running legal battle against Ripple. A joint motion was filed to pause the appeal process as both sides worked toward a settlement. This adds to the overall regulatory shift seen under the new administration.

The Bigger Picture

Together, these developments show a clear change in direction:

- The U.S. is starting to embrace digital assets

- Lawmakers are focusing more on innovation than punishment

- Agencies like the SEC and IRS are being pushed to clarify and simplify rules

For the world of crypto, it might be the start of a freer and more nurturing era. Investors and developers alike may see it as simpler to invest and develop, with fewer legal obstacles to overcome.