Key takeaways

- MicroStrategy intends to raise $2 billion to acquire more Bitcoin.

- The company aims to increase its Bitcoin holdings with a “21/21 Plan”.

Share this article

MicroStrategy revealed plans to raise up to $2 billion through public offerings of perpetual preferred stock to strengthen its balance sheet and fund more Bitcoin purchases.

The planned stock offering is part of MicroStrategy’s “21/21 Plan,” which aims to raise $21 billion in stocks and an additional $21 billion through fixed-income instruments, including securities. debt, convertible bonds and preferred shares over three years.

The offering is expected to occur in the first quarter of 2025, subject to market conditions and the company’s discretion, as stated in the release. The final terms, including the number of depositary shares and the price, have not been determined.

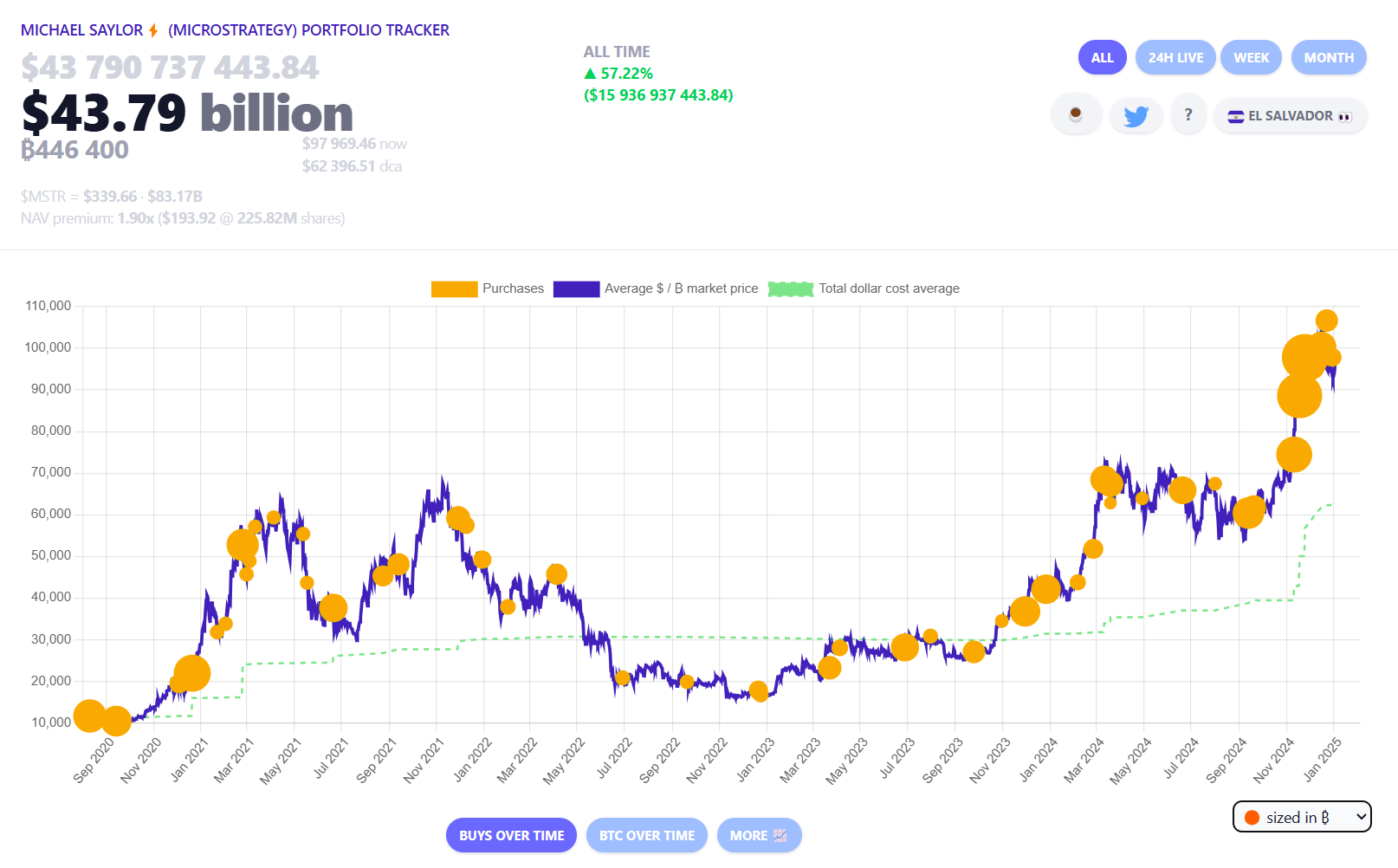

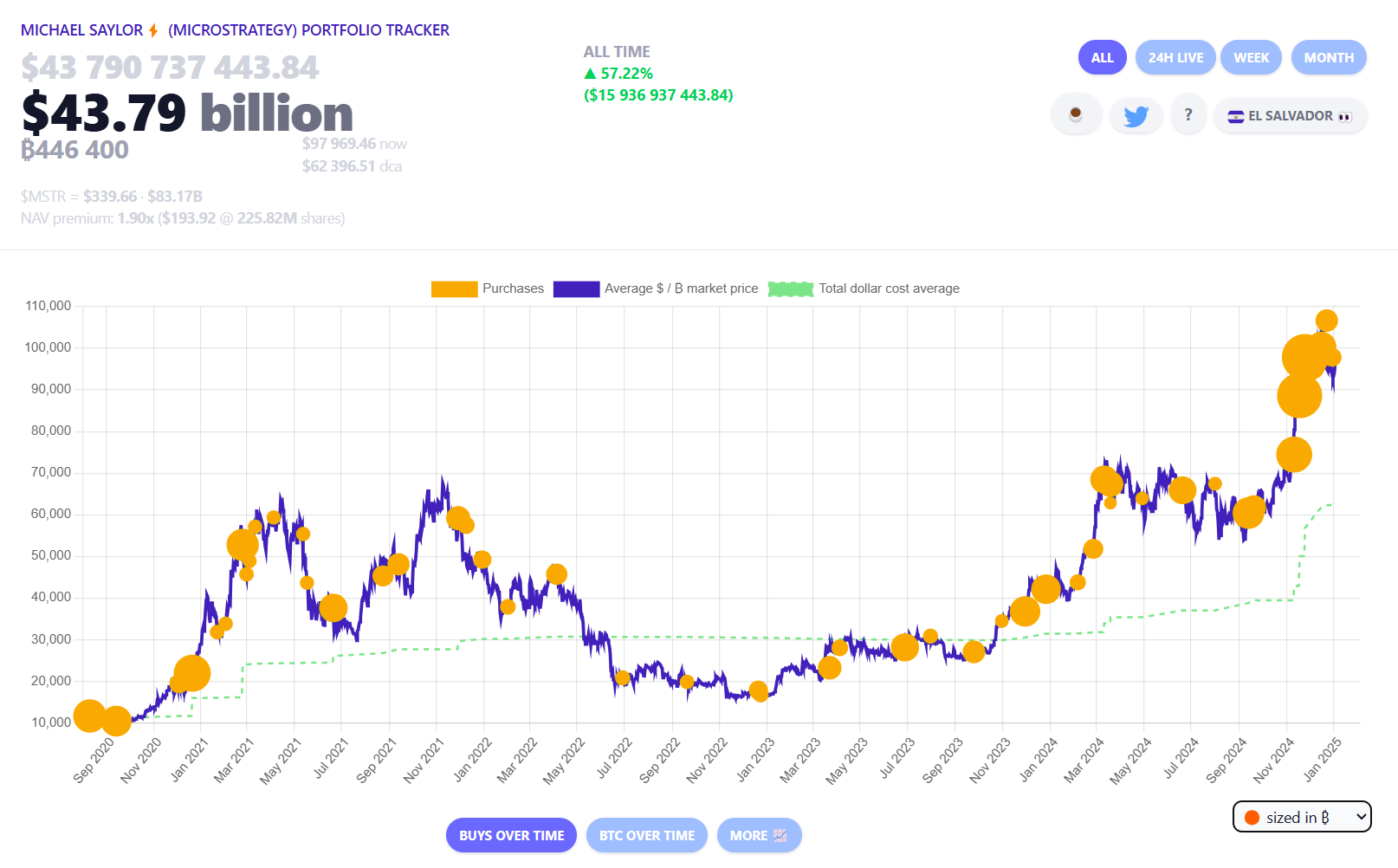

The Tysons, Virginia-based company has acquired 194,180 BTC since launching its “21/21 Plan” last October, representing approximately 45% of its investment goal. At current market prices, these holdings are valued at $19 billion.

MicroStrategy will hold a shareholder meeting via webcast to vote on increasing its authorized common stock to 10.3 billion shares from 330 million and its preferred stock to 1 billion shares from 5 million, among other proposals. The meeting will be open to shareholders of record on a date to be determined in 2025.

As of January 3, MicroStrategy held 446,400 BTC, valued at approximately $43.7 billion, with unrealized gains of approximately $16 billion.

Share this article